By Kevin Knill Ph.D., Director of Products & Services

“It’s the dawn of a new era being a cognitive business. When every product, every service, how you run your company can actually have a piece that learns and thinks as part of it – then you have a cognitive business.”

Ginni Rometty, Chairman & CEO, IBM

Recent advances in cognitive technology make life insurance underwriters more effective at assessing policy applications. This technology allows life carriers to extract key data from documents, process it into relevant information, and present it back to Underwriters – all within the context of their normal application review process.

Anecdotal evidence indicates that this can increase the productivity of underwriters by 30% when assessing complicated applications. More importantly, this means underwriters can come to a more precise rating that reduces overall Carrier risk.

The Challenge With Rating Risk

Many carriers struggle to produce consistent policy ratings which increase the overall portfolio risk. Complex applications present a myriad of possibilities for underwriters to assess, making them the main culprits for inconsistent policy ratings and longer-than-needed approval times.

The most difficult cases have a set of medical documents (attending physician statements, lab reports, etc.) that describe a patient’s history. Beyond that, the underwriter might also need to request a paramedical examination, conduct a telephone interview, or obtain a prescription history and existing declared diagnoses. Throw in motor vehicle records and identity information, and now you have a complete picture.

To accurately assess a complex application, underwriters must understand the severity of an applicant’s conditions and the potential for cumulative diagnoses exacerbating that condition, while appreciating the applicant’s desire to take corrective action.

Complex applications that demand scrutinous review typically generate a “decline,” “standard” or “substandard” rating, depending on the underwriter.

It’s a lot of information for an underwriter to assimilate in a short period. And don’t forget the added competitive pressures to approve or deny a policy as fast as possible. Saying that it is a challenge to make an assessment that wins business while minimizing risk exposure, is an understatement.

How Cognitive Capture Delivers Greater Insight

One way to help underwriters make consistent decisions is to present the applicant’s medical data in a consistent and repeatable way. What I mean by this is, traditional systems simply provide the documents and the insurer relies on the underwriter’s ability and skill level to assess these documents properly.

Visionary systems extract an applicant’s salient diagnoses and prescription history using cognitive OCR engines, then correlate these histories to help the underwriter better-appreciate the information.

For example, knowing that an applicant had a condition for which they took a specific drug at a dosage considered severe, is helpful. Knowing that an applicant had two simultaneous conditions that complicated the treatment plan and increased the risk of mortality is even better.

Policy underwriting software, like Pyramid eXpeditor (PX) for Underwriting, organizes diagnoses by severity so underwriters can focus on what is important. It can even identify undeclared or underreported ailments to trigger further investigation or a high table rating.

Smart Systems Learn from Underwriters’ Decisions

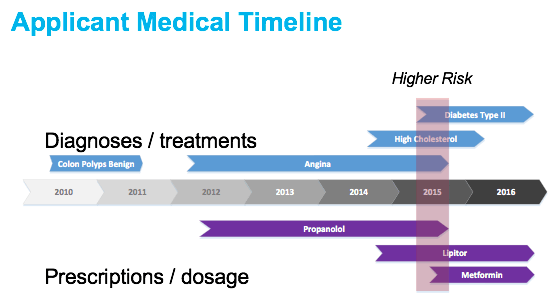

While reviewing documents, underwriters can trace individual conditions across documents/reports/test results, etc. to make a final assessment. In the image below, PX for Underwriting produced a real-time graphical storyline of an applicant’s medical history, which reveals high risk in 2015 because of overlapping diagnoses and medications.

The system learns what information is important, what needs to be improved, and what is critical based on every assessment and decision the underwriter records. Over time, the system presents the underwriter with a more consistent set of information on which to make their decision. The expectation is that this approach will lead to a more consistent and precise rating that reduces each policy’s risk.

Graphical Storyline of Applicant’s Medical History

Graphical Storyline of Applicant’s Medical History

Leveraging cognitive capture and reporting leads to overall business improvement. A precise rating system gives life insurance companies insight to make adjustments that reflect their own client demographics and business metrics, the ability to interface better with their Reinsurance partner(s), and a streamlined underwriting process – ultimately driving down risk and operating costs.

Read another one of Kevin’s blogs: Stakes Risking in Life Insurance Industry.

About the author: Kevin Knill, Ph.D. has been at Pyramid Solutions for almost eight years. He worked in a variety of industries prior, but now immerses himself in the banking and insurance industries to bring visionary solutions to life as the Director of Products. A true Canadian, Kevin enjoys the cold and is an avid hockey fan who still participates in coaching little league hockey teams in metro Detroit.