Deliver fast, efficient claim settlements.

Designed to help insurance carriers with the challenges of managing unstructured processes and content related to a claim, providers can now process complex claims faster by utilizing a single interface regardless of the content’s format or system it resides in.

Obtain faster claims processing with content management.

Why deal with a system of disorganized, unsecured content that only slows your claims processing? Built to seamlessly integrate with third-party systems of record (SOR) such as Guidewire ClaimCenter and Duck Creek, our Content Solution leverages the latest technology in data capture, cognitive computing, advanced case management, enterprise content management and electronic signature — allowing you to simultaneously deliver secured content to multiple business areas and users across an enterprise.

With our solution, you’ll extend your SOR by managing business data and integrations within business processes through our Content Services offering. Enabling a claims solution with Content Services allows both platforms to be used to their maximum potential, while ensuring users get the most out of their documents. Using our solution to externalize content accelerates claims processing and improves business capabilities and efficiencies across an enterprise, which in turn provides better customer experiences.

Benefits

• Break down departmental silos and enable cross-departmental collaboration

• Decrease errors and duplicates due to manual paper processing

• Leverage human knowledge and expertise resulting in faster cycle times and quicker time to settlement

• Increase settlement accuracy and decrease overpayment or underpayments

• Integrates and extends existing systems of record capabilities

• Handle unstructured content and processes within the claims process with parallel processing

• Search and retrieve content from a single interface

What Our Solution Can Do

Records Management

Automate auditing, reporting and legal holds of content to ensure the destruction and disposal policies are enforced.

System of Record Enablement

Automatically allow users to obtain the information and content they need to work efficiently.

Content

Delivery

Efficiently assemble and deliver large sets of content.

Bulk

Uploads

Stop making users upload files one at a time — enable speed with our simple bulk upload solution.

What Our Solution Can Do

Records Management

Automate auditing, reporting and legal holds of content to ensure the destruction and disposal policies are enforced.

System of Record Enablement

Automatically allow users to obtain the information and content they need to work efficiently.

Content

Delivery

Efficiently assemble and deliver large sets of content.

Bulk

Uploads

Stop making users upload files one at a time — enable speed with our simple bulk upload solution.

Focus on Your Customer

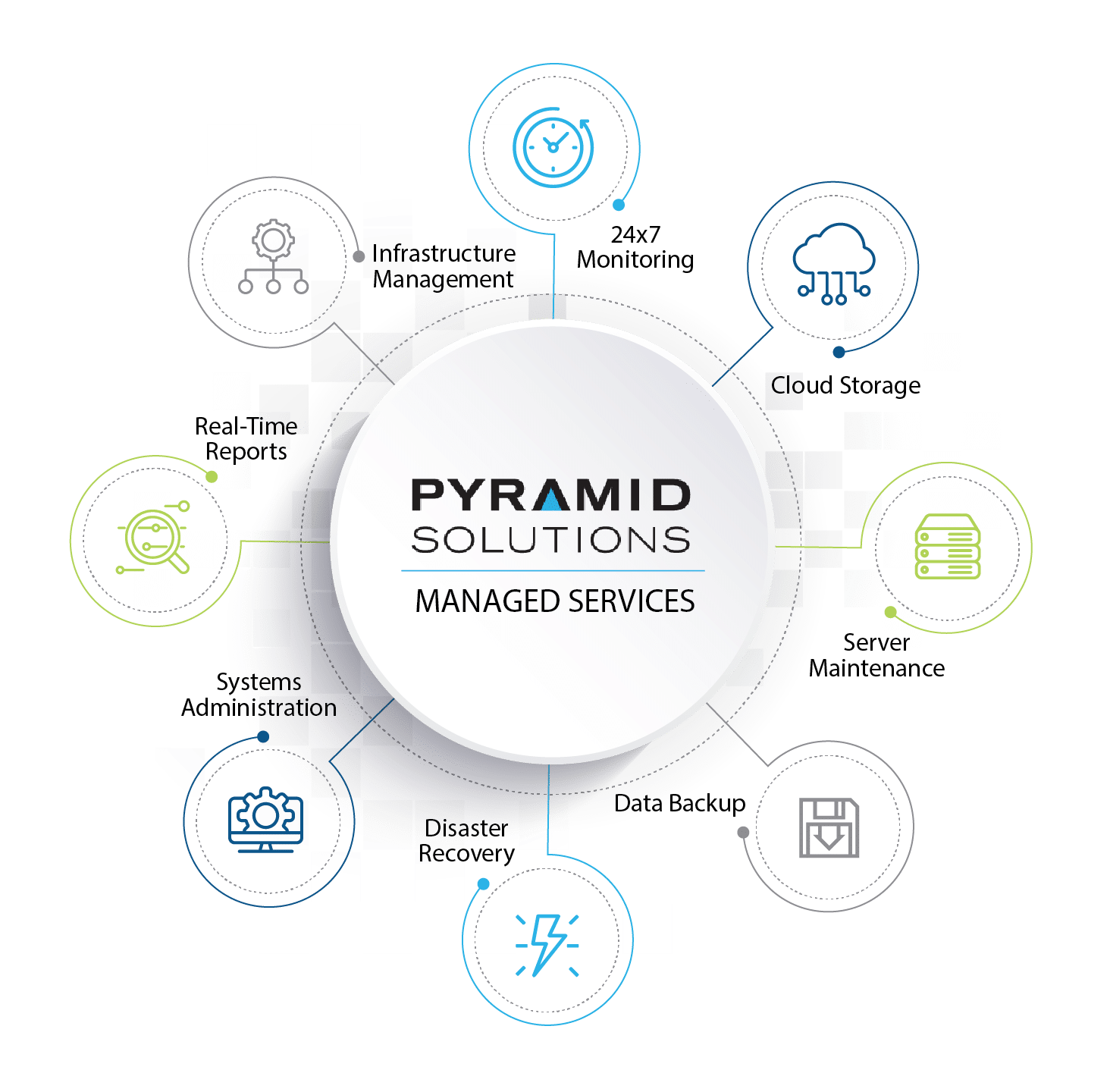

We’ll Focus on IT…

Why burden your team with building, deploying, and maintaining your infrastructure and applications?

Pyramid Solutions’ Managed Services provides you the assurance and time to focus on providing new innovative services to your customers. With a secure environment and guaranteed high availability, your applications will be humming 24×7.

From building out your cloud strategy to customizing applications to deployment, let Pyramid Solutions handle it.

Resources

Insurance Content Case Studies

• Leading Insurer Goes Paperless and Optimizes GuideWire ClaimsCenter

•North American Insurance Group Enhances Guidewire ClaimsCenter

Speak With an Insurance Expert

We understand the frustration of dealing with disorganized, cluttered content and multiple silos — we’ve dealt with it for more than 20 years with clients from multiple industries.

We can help drive your claims processing to be more efficient with document processing, IDP and content services. With over 20 years of experience in deploying content services, particularly in the insurance sector, we know the best way to configure content services to be able to integrate as seamlessly as possible with your system of record. Reach out to get a free consultation on how we can make your content processes be better than ever.