With a focus on property and casualty (P&C) insurance, our Underwriting Solution extends your current underwriting engine’s capabilities from capturing client information to issuing a policy. Ensuring underwriters work efficiently every step of the way.

Accurate Evaluations

Improve Agent Loyalty

Fewer Risks & Losses

Seamless Integrations

Quickly Collect and Process Client Information

Improve Underwriter Efficiency

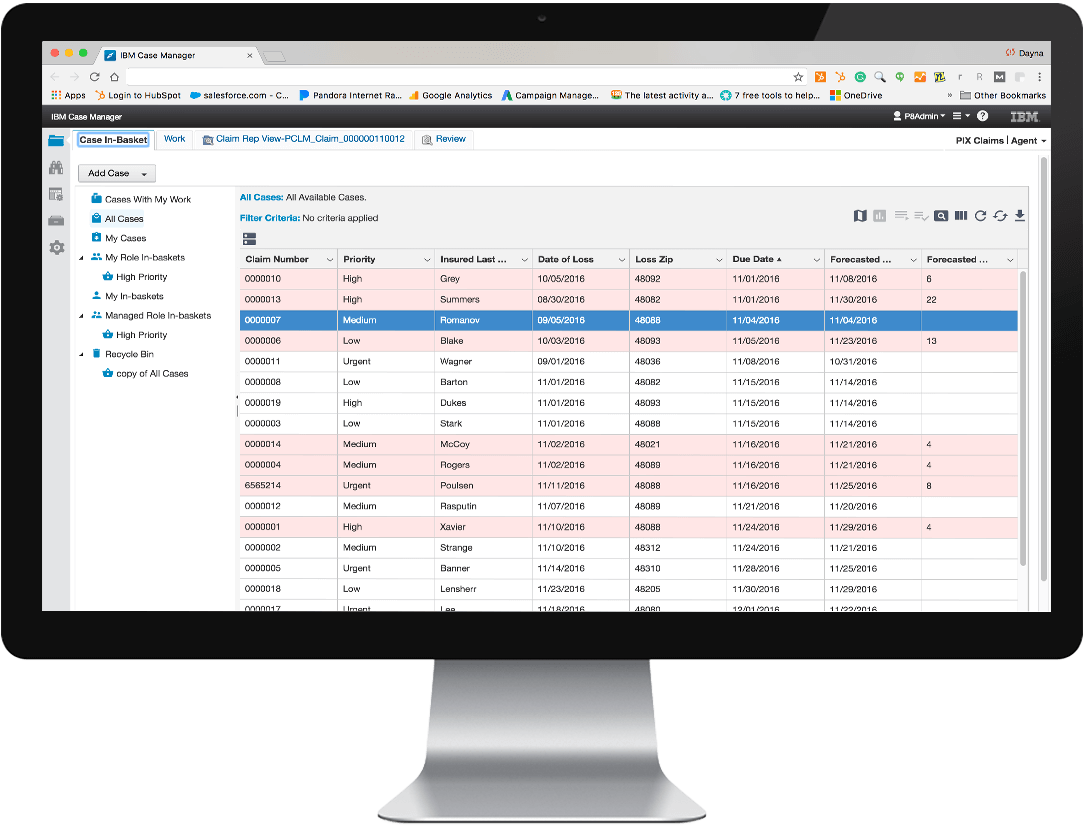

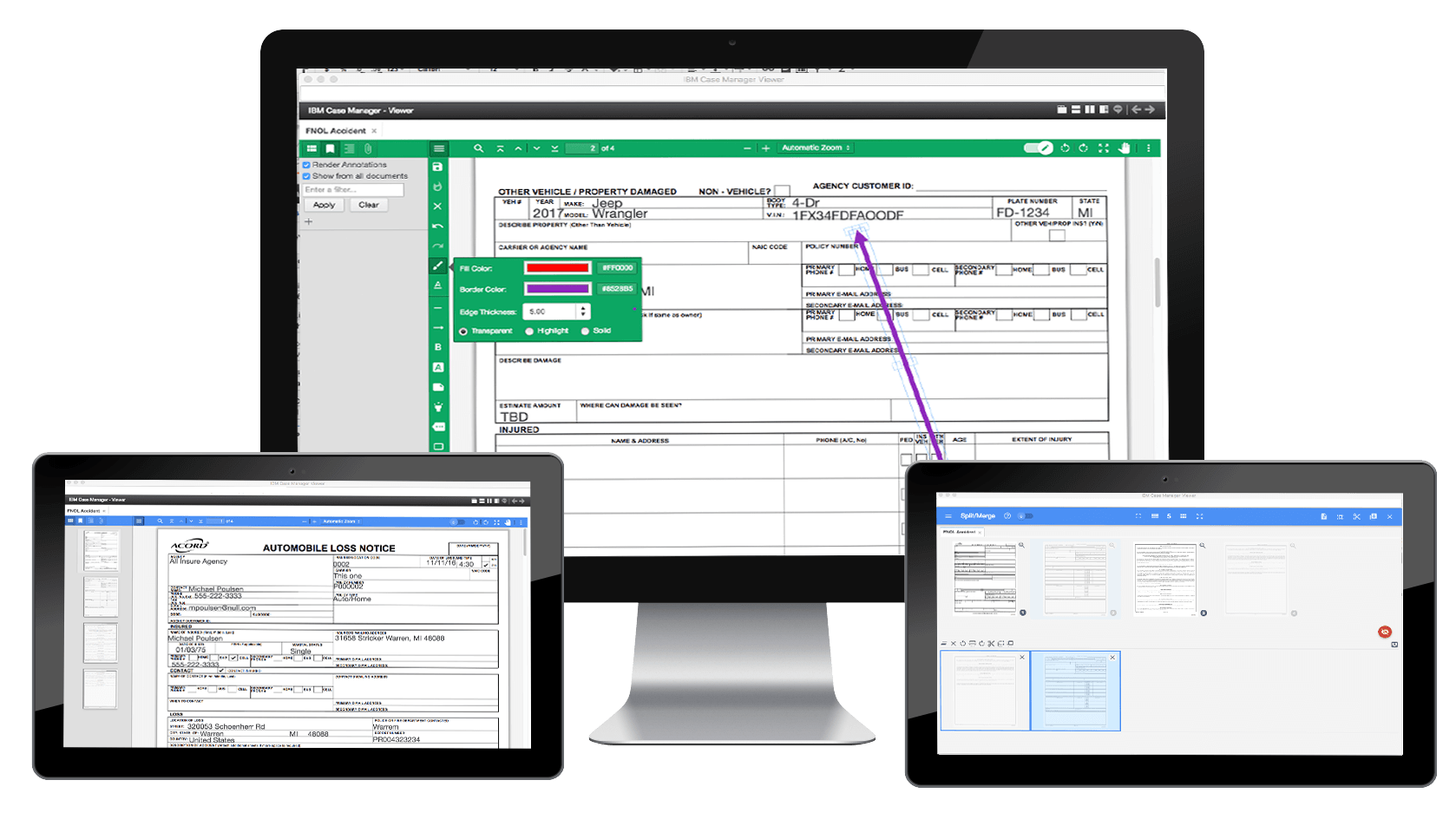

Why make an underwriter’s job harder than it has to be? Stop making them jump from application to application looking for correct information or documents. Why not give them a single application where they can complete all their work? Our solution does just that.

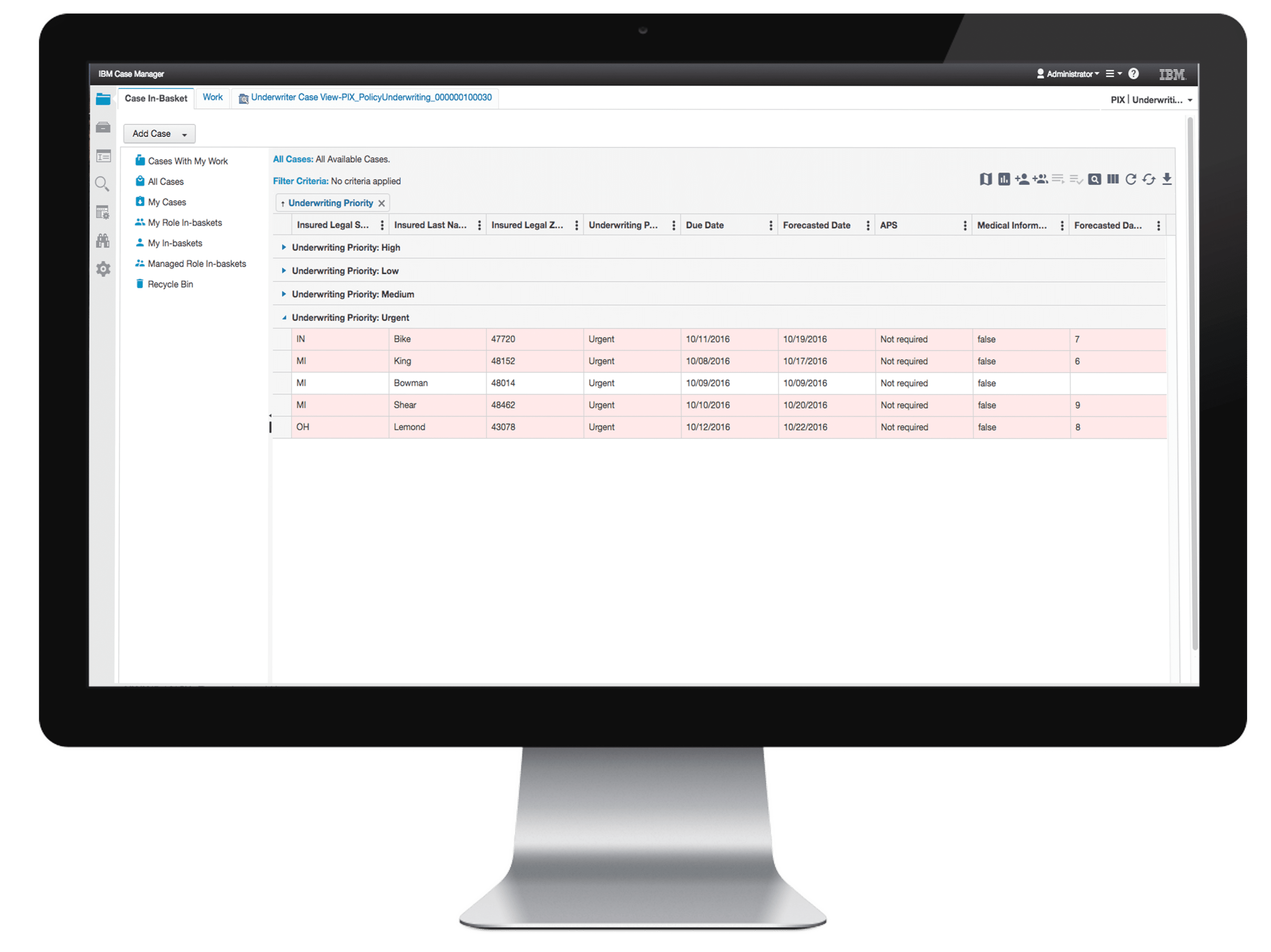

From a single interface, underwriters can see all applications with priority ratings and process-specific tags so they know which to review first, what state the application is in, and how to proceed. Fully equipped with exception-based workflows, the solution takes mundane manual tasks and automates them. For example, it can capture an applicant’s data while simultaneously flagging missing fields on a document and pulling up any of the client’s historical information/prior cases. Your organization can arrange workflows and rules for fast-track applications so your underwriters can channel more time toward reviewing complicated applications that need their eyes, experience and expertise.

Your Underwriters Workbench

Already using Guidewire PolicyCenter?

Integrate directly into PolicyCenter for the best of both worlds.

Make Underwriting Easier

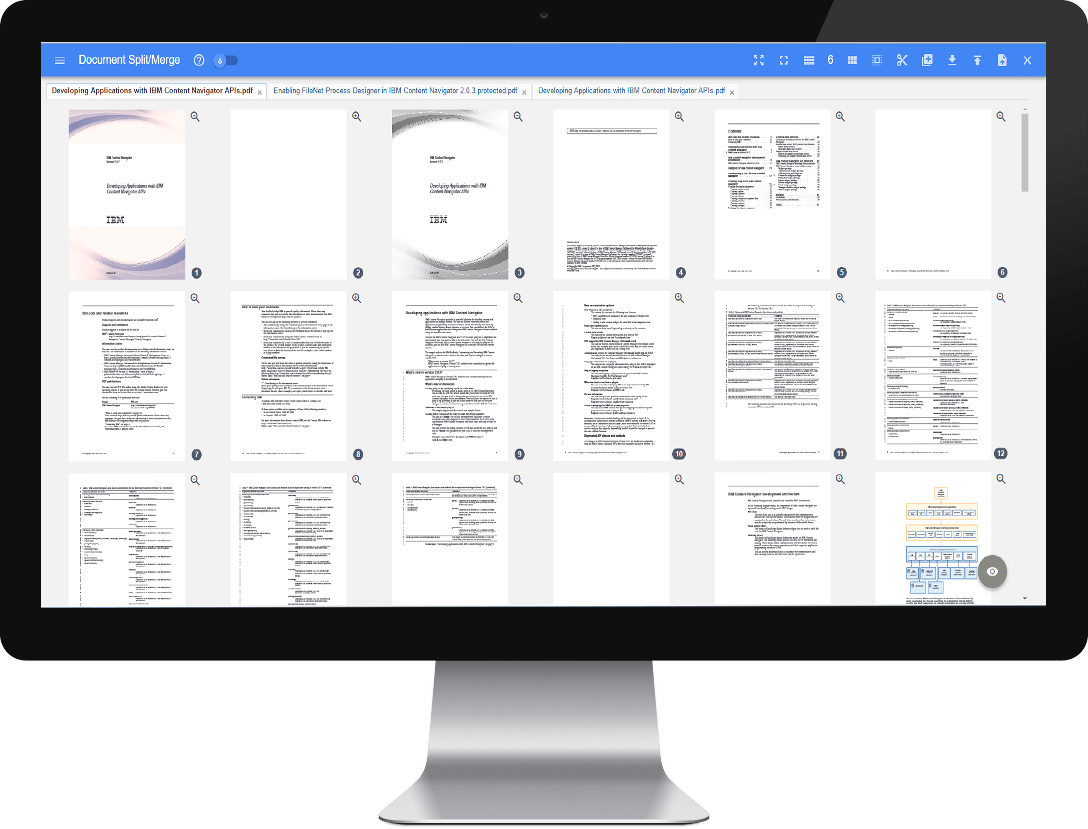

Split & Merge Documents

Extract a signature page out of a large document to send to your client then easily merge it back in.

Comments Feed

Provide your employees with a way to communicate with each other, comment on documents, and complete customer files and folders.

Cross-Repository Searching

Bridge disparate systems together so your underwriters can find what they need fast.

Bookmarks

Bookmark specific pages to mark important information like a VIN or signature line to quickly jump to it in the future.

Focus on Your Customer

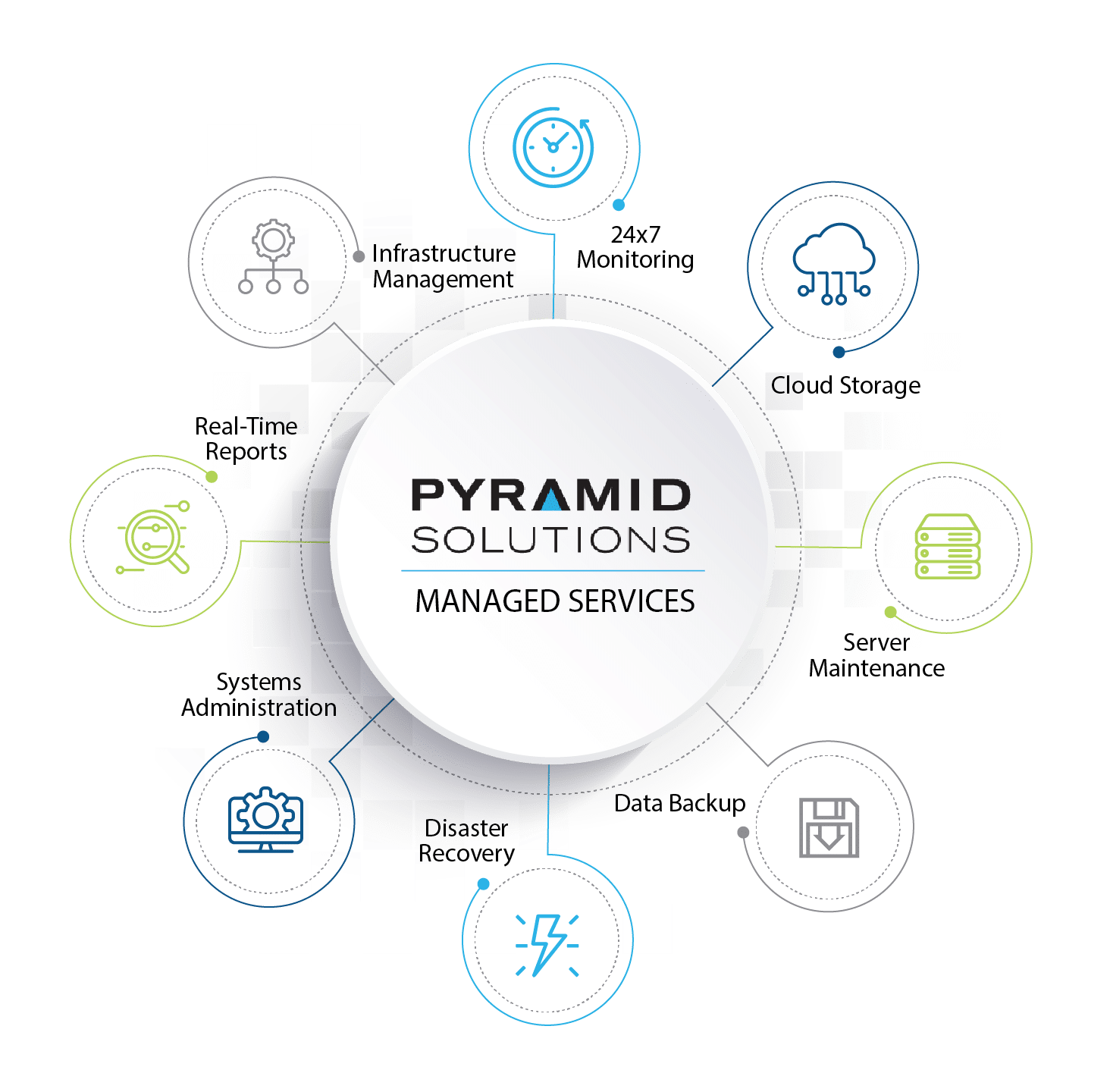

We’ll Focus on IT…

Why burden your team with the unwanted stress of building, deploying, and maintaining your infrastructure and applications?

Pyramid Solutions’ Managed Services provides you the assurance and time to focus on providing new innovative services to your customers. With a secure environment and guaranteed high availability, your applications will be humming 24×7.

From building out your cloud strategy to customizing applications to deployment, let Pyramid Solutions handle it.

Additional Resources

Discover MoreHyperautomation for Insurance: Exceeding Customer Expectation with Robotic Process Automation

Listen to Jay Sarzen, Senior Analyst at Aite Group, and Will Sellenraad, Insurance Principal at Pyramid Solutions, to hear how P&C providers are using RPA to focus their claims departments more on customer interactions by automating necessary low value added tasks with RPA.

3 Fundamentals to Consider For Your Accelerated Underwriting Solution

Before implementing any new technology that claims to increase efficiency, current underwriting processes need to be straightened out so that they make the most sense for the actual decision-makers—the underwriters. Let’s explore a few of the fundamentals that every insurance provider should keep in mind in order to execute a successful accelerated underwriting solution.

Technology Is Changing the Role of Insurance CIOs

Advancements in technology have allowed insurance CIOs to step back and look at the way the business is operating and how products are being delivered.