Underwrite More Policies in Less Time

Enhance your underwriting process with a solution that leverages the latest in case management, cognitive capture, advanced analytics and workflow technology to reduce the time it takes to process an application.

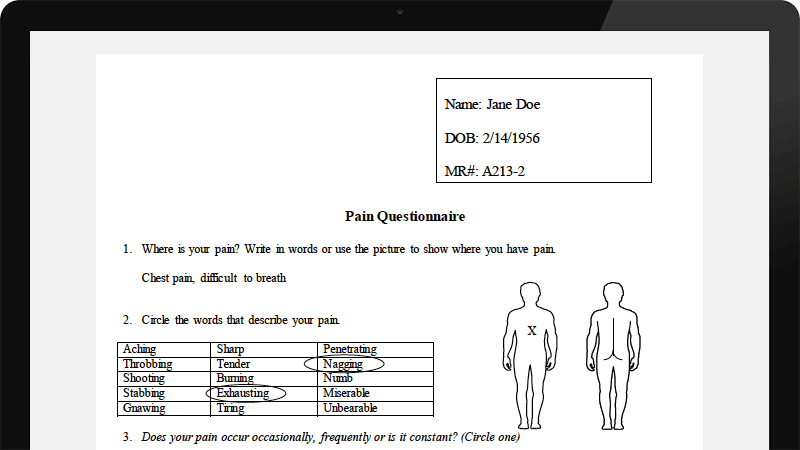

Powered by Cognitive Capture

and Advanced Analytics

From obtaining customer information to approving applications, our Life Underwriting Solution complements your existing underwriting system to accelerate the process every step of the way.

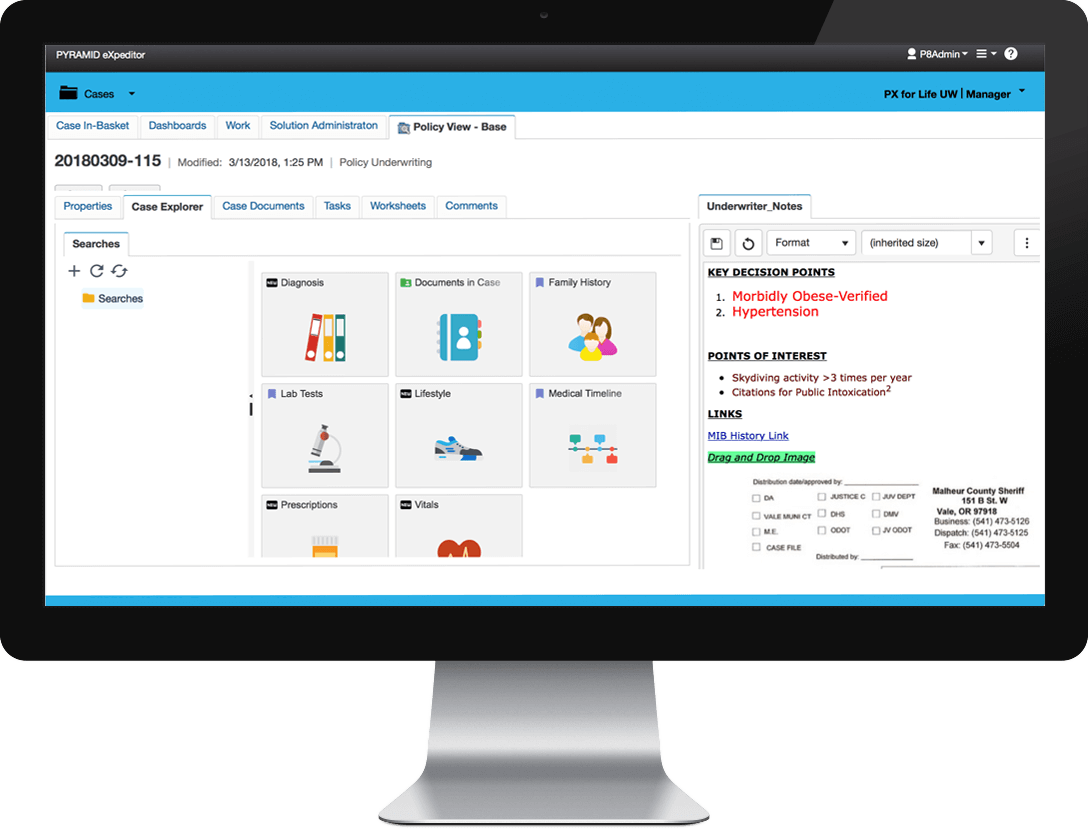

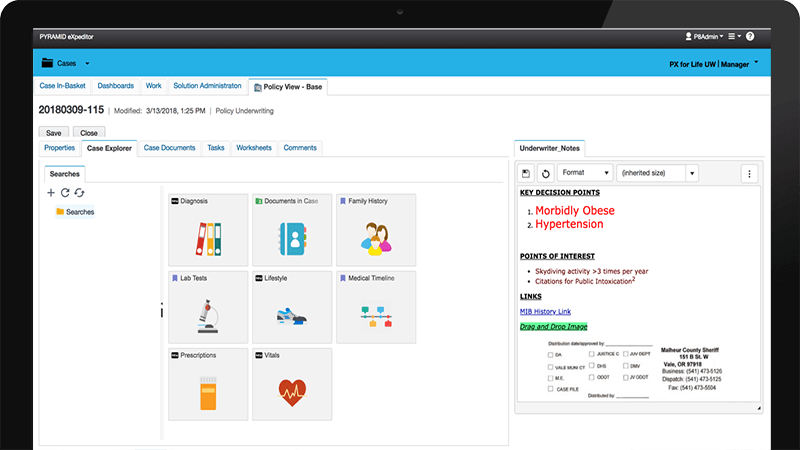

Only Review Information That Matters

If they instantly knew an applicant had any indication of these in their file would it save them money and time to quickly deny the applicant?

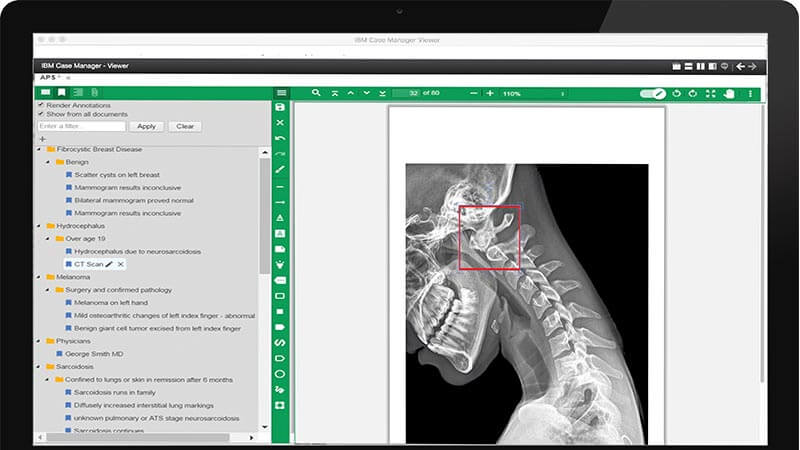

That’s exactly what the Pyramid Solutions Life Underwriting Solution does. It captures anything related to the three leading causes of death, cleans the information by removing duplicates, identifies handwriting, and classifies the information into easy-to-consume dashboards and reports, providing underwriters with one-cilck access to information.

For example:

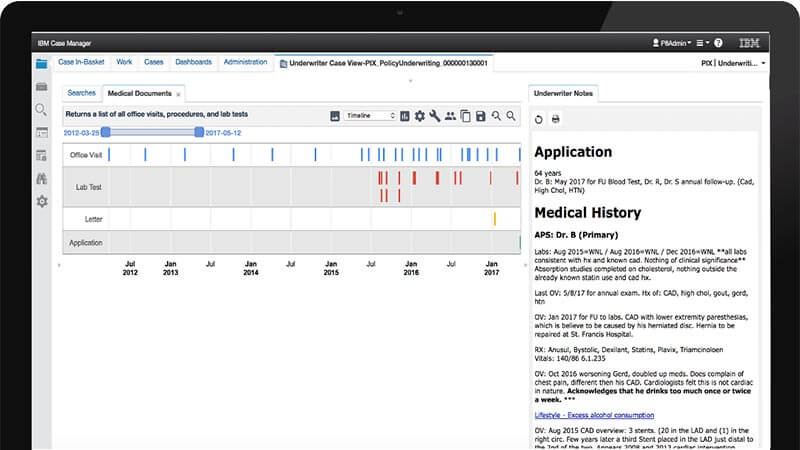

If your capture system gave you a name such as “Dr. Williams,” it would be meaningless. Nothing can be done with “Dr. Williams.”

If it put the word “Cardiologist” in front of it, you have an idea of what the name means. If an address is also provided, now you have something to work with.

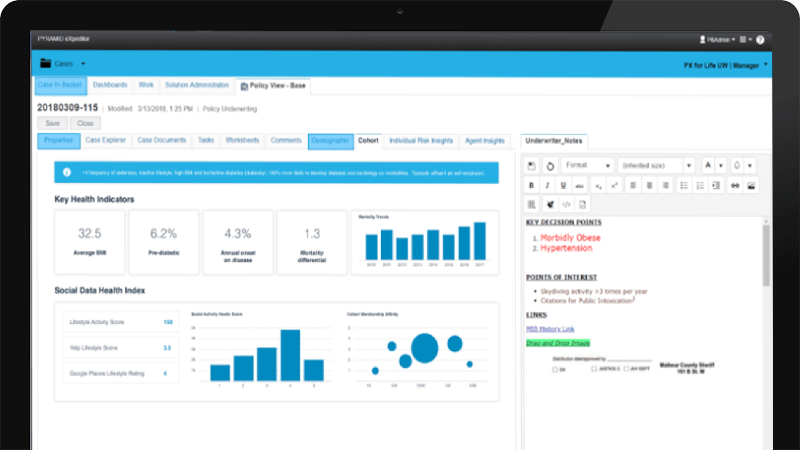

Gain Deeper Analytical Insights

With our built-in analytics, you can loosen dependence on senior underwriters and unlock the value of your data to provide accurate and consistent rating scores. Easily understand:

- Key health indicators

- Average body mass index

- Disposition of diabetes

- Mortality differentials

- Risk scores based on data sources from:

- MIB

- MVR

- Prescription history

- Policy application

- Lifestyle data

- MIB Insurance Activity Index

- Individual Risk insights

- Diagnostics conditions

- Potential conditions

- Lifestyle

- Credit score

- Geographic clusters based on cancer, diabetes and heart disease

- Estimated deaths in upcoming years based on historical data

- Past incident ratings

- Estimated deaths in upcoming years based on historical data

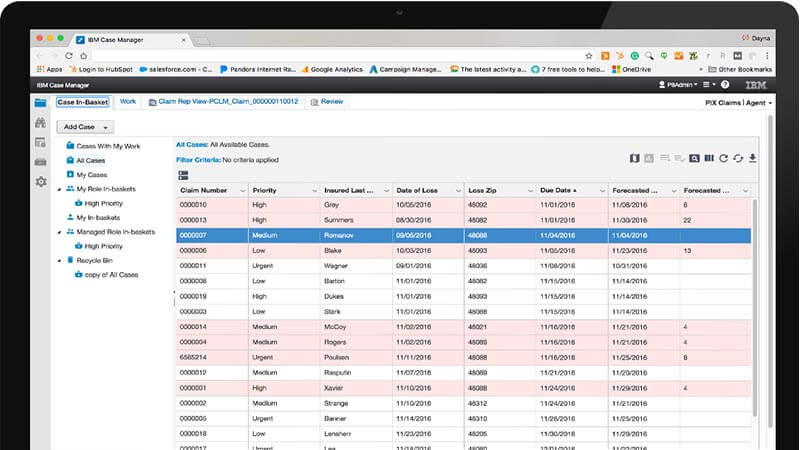

Streamline With Automation

- Assign tasks and cases to specific underwriters based on skill level

- Facilitate application approvals and denials

- Request more information from clients

- Put an application on hold

- Perform searches

- Pull information from third-party data sources

- Publish and share underwriter notes

- Request an APS

- Check if the applicant has applied before

- Check to see if the applicant has any previous fraudulent activities

- and more.

Work from a Single Interface

With a unified view, underwriters no longer need to jump from application to application to complete their work. They now have access to many tools and capabilities:

- Customized or pre-built dashboards for easy assessments

- Built-in “to-do” lists to keep them on track

- Split a document apart

- Merge documents together

- Redact sensitive information before sending it out

- Collaborate in real-time with colleagues

- Take notes about your decision and publish them

- Organize case documents

- Search, find, view and share content

…just to name a few.

Extend Your Initial Investments

With our Life Underwriting Solution, you won’t have to shut down productions because it is designed and built to complement your existing process by seamlessly integrating into it and offering a smooth experience for your underwriters.

See the Bigger Picture

Task lists display all the completed and upcoming tasks needed to move an application through the process so managers and underwriters can see what steps are left in the process, what stage the application is in and what work has already been completed. Comprehensive dashboards can display your team’s throughput rates, where bottlenecks exist, which applications are in danger of taking too long and how old an application is. A comments feed reveals real-time conversations between teammates and notes from underwriters regarding decisions made on an application. Case folders contain all the content associated to an application.

Accelerated Underwriting: Foundational Pieces for Success

There are a lot of things going against underwriters – from a changing marketplace to the complexity of underwriting, but leveraging cognitive capture, case management and predictive analytics are ways to start off on the right foot.

Focus on Your Customer

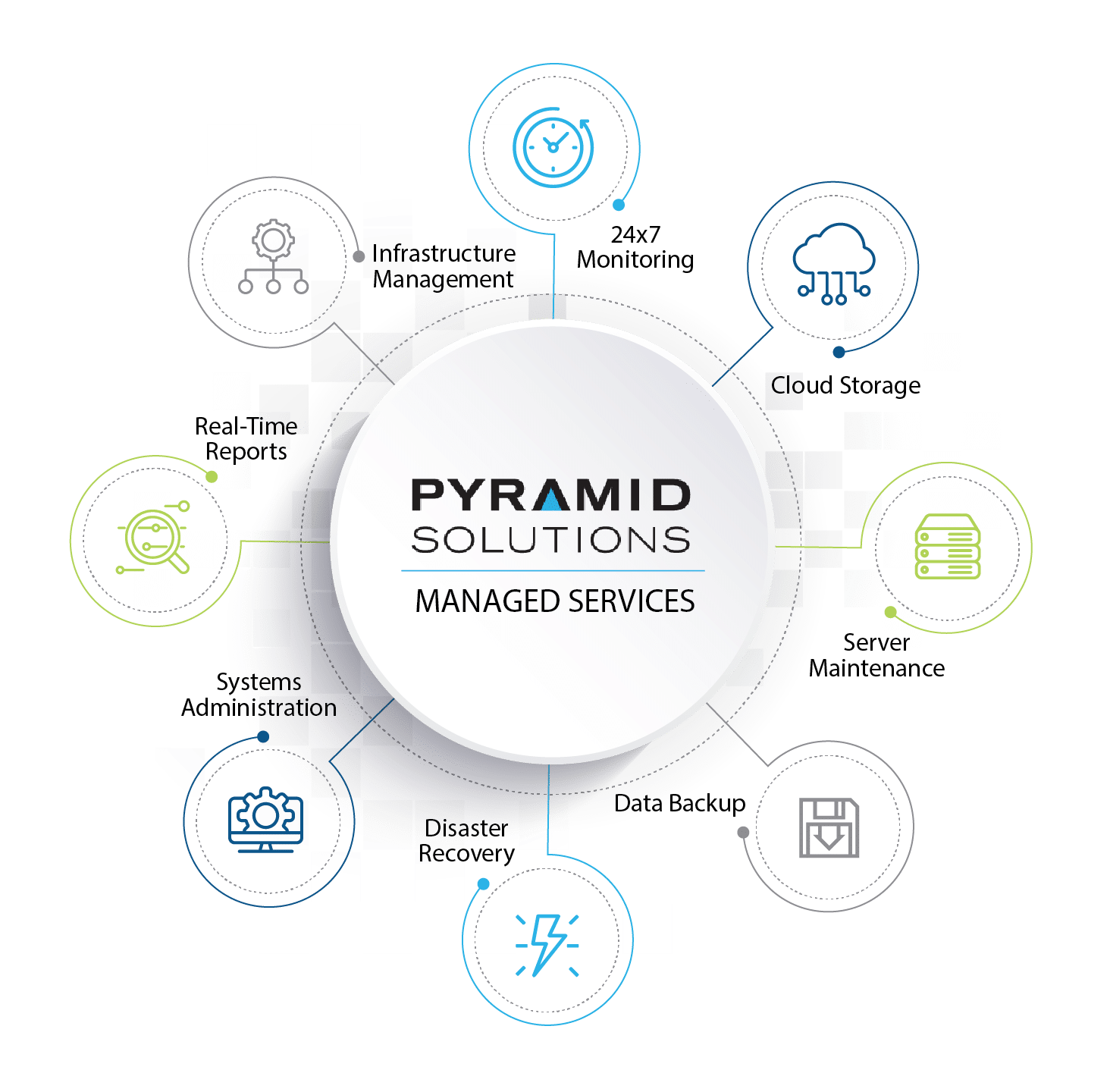

We’ll Focus on IT…

Why burden your team with the unwanted stress of building, deploying, and maintaining your infrastructure and applications?

Pyramid Solutions’ Managed Services provides you the assurance and time to focus on providing new innovative services to your customers. With a secure environment and guaranteed high availability, your applications will be humming 24×7.

From building out your cloud strategy to customizing applications to deployment, let Pyramid Solutions handle it.

Underwrite Efficiently

Reduce Overall Risk

Produce Consistent Ratings and Risk Scores

White Paper: Medical Extraction: The First Step in the Journey in Accelerated Underwriting

Discover the possibilities of expediting your accelerated underwriting program with Medical Extraction.

How to Fast-Track Applications: Natural Language Processing for Life Insurance

Achieve organic growth with natural language processing to fast-track low-risk applications. Read More

IBM Datacap Insight Edition: Not Your Mother’s Capture Solution

Document capture is making leaps and bounds. Ssee what we’re doing with the IBM Datacap cocument management tool. Read Now