What exactly are the top challenges in life insurance underwriting? What is this ‘monstrous obstacle’? Talk to any life insurance company and they will tell you that an attending physician statement (APS) (also referred to as digital or electronic medical records) is the biggest delay in underwriting new applications.

Ordering an APS is expensive ($50-$150 each), takes time to retrieve (10-30+ days), and is necessary for 20-30% of all life insurance applications (and if it is reinsurance, they require an APS for each application).

In addition, APSs are big and getting bigger. An average APS document is 200-300 pages. We witnessed VA applicants whose APS can balloon to 11,000 pages.

It is painstaking for time-constrained underwriters to review all essential details of an APS. We talked to underwriters whose review of a 200-page statement consumes an hour. This means that the 11,000-page VA record could consume a couple of weeks! To compound this problem even further, in a world of copy, cut, and paste, many APSs contain duplicate information and pages.

It is easy to see how sifting through an APS is like falling into a vortex. One Chief Underwriter told us he resorted to reviewing all the big APSs himself just to keep his team productive.

Why APSs Are Not Just a Problem, but a Monstrous Obstacle

In the digital age, competitive advantage means economically compressing time to assess risk and issue a policy. Today’s applicant expects a self-directed online experience with minimal hassle and a positive outcome.

There is a lot of consumer pressure to shorten the application approval process. The life insurance industry faces real threats of disruptive companies upending their business.

Google, Amazon, Walmart, and a number of startups have been studying the life insurance space as ripe for disruption. Why? Because these companies compile vast amounts of data on an emerging target market (millennials having children) that will want life insurance soon. When their customers search for products related to pregnancy such as a crib, why not mine this profile to offer them some life insurance?

Future customers will demand a fast, web-based application to get life insurance. Fluid tests, physicals, and APS documents do not fit in this new equation.

Finding the APS Role in the Equation

Obviously, we cannot take the APS out of the equation. As an example, if a 45-year-old applicant requests a $500,000 policy, an underwriter will request an APS so he/she can conduct a thorough risk analysis. This complete record from a physician about a patient’s health is the single most important document to underwrite a high-risk or high-face-value application.

The APS is necessary. However, it’s listed as the top challenge of life insurance underwriting for a reason. Reading every single page of it just isn’t practical.

When we started investigating solutions to help life insurance underwriters, we talked with our current insurance clients and industry trade groups. This led us to initially think there was simply a demand for a faster way to search, retrieve, and review all of an applicant’s content, so we focused on the APS and all supporting data.

We then challenged that thinking, spent more time listening, and realized a startling revelation: Underwriters want to eliminate the manual review of any and all content.

Their dream world is to process applicants who fit the ideal profile the moment they hit the submit button – no reading, no searching. For applicants outside of the ideal profile, a productivity tool would analyze and organize the applicant’s data in a manner that enabled underwriters to quickly and accurately assess risk and issue a policy.

We think a live underwriter can make better and faster decisions than an artificial robot when the applicant’s data is properly presented.

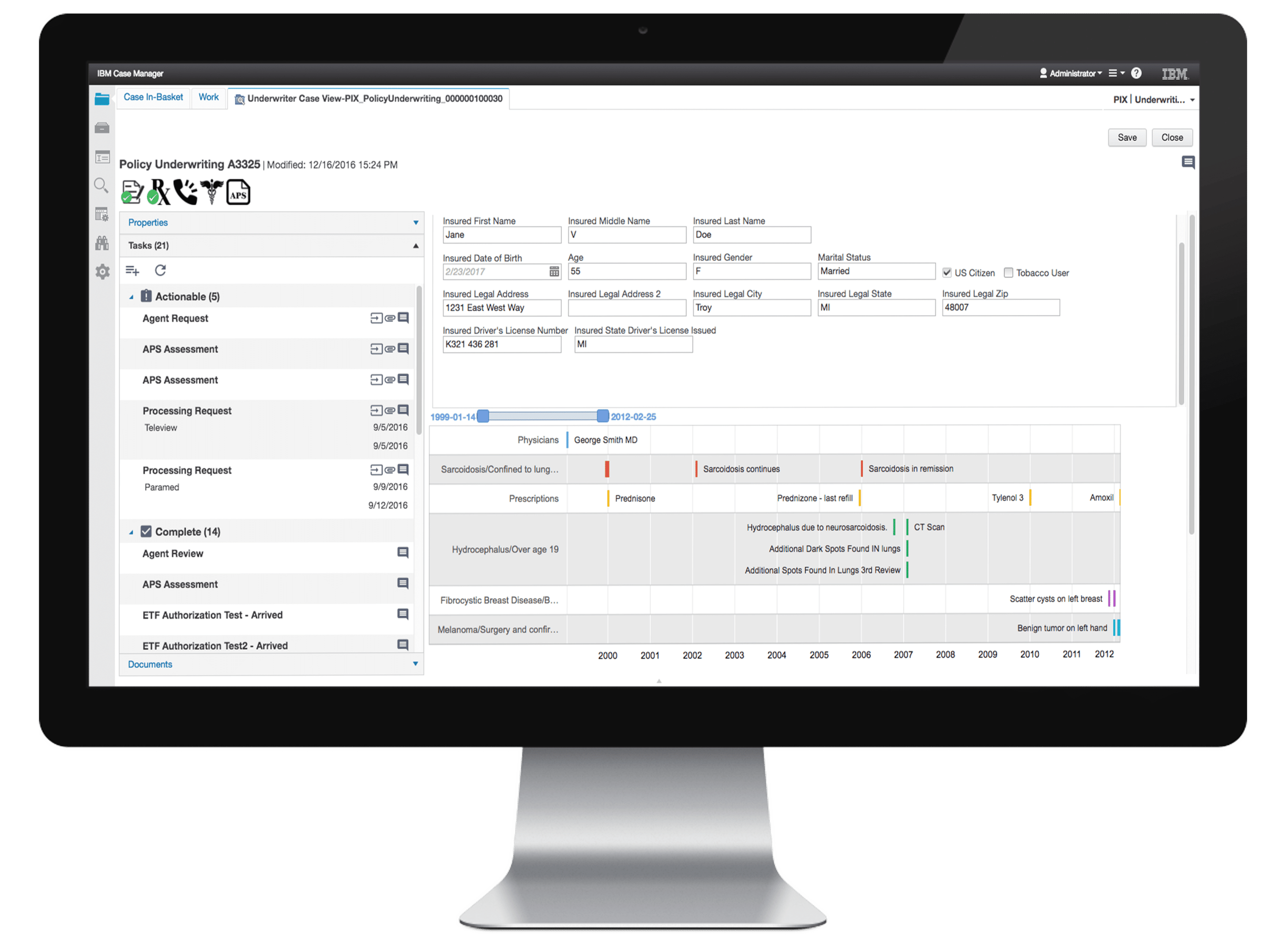

We took that vision to our Product Team who incorporated a graphical applicant ailment storyline into our life underwriting workbench. The storyline organizes all of the applicant’s data into a graphical timeline. An underwriter can now quickly review and issue a policy without ordering an APS, jumping between different applications, and manually analyzing data.

I guess dreams do come true.

About the author: Will enjoys applying innovative technology to fundamentally change how a business works. When he is not thinking about improving worker efficiency he is thinking about improving his golf efficiency.