By Layne Alfred, Marketing Associate

2018 was a transformational year for the insurance industry. Technologies like digital applications for clients and other advanced forms of product delivery were extremely innovative and industry-shaping. Many top insurance companies entered 2018 already having implemented accelerated underwriting solutions and digitized the flow of a customer’s experience. While these were hugely beneficial transformations, insurance CIOs can’t slow down or become complacent. With the rapid development of technology, insurance companies need to keep up on trends in 2019 and continue to implement cutting-edge tools to maintain a competitive edge.

A Look Back at Insurance CIOs’ Top Initiatives for 2018

LOMA Resource asked the CIOs of four insurance companies what their top initiatives were for 2018, all of whom referenced self-service capabilities for clients and other customer experience-related priorities. Among these included digital sales support, digital applications and enrollment capabilities. “Over the prior few years, we have navigated away from a focus on large stand-alone initiatives to focus more on the experience we deliver to our advisers and policy-holders,” said Greg Driscoll, Senior Vice President Service Operations and CIO of The Penn Mutual Life Insurance Company.[1] This cultural shift was prevalent in insurance companies in 2018 in an effort to meet a rising demand for convenience.

Another top initiative was modernizing core legacy systems and migrating content to the cloud. In doing so, insurance companies have been able to implement higher-level information protection and cybersecurity since older legacy systems are vulnerable and are difficult to update to the latest security enhancements. These updates to old legacy systems have allowed for more compliance and implementation of advanced technologies like artificial intelligence.

CIOs also mentioned the advancement of master data management (MDM) as a major push to help increase customer satisfaction. Advanced data is becoming more important for insurers to have better insight into what their customer base expects in terms of user experience. “We’re focused on modernizing our approach to MDM by improving our speed at obtaining quality, consolidated data from across the entire organization… [this] will significantly enhance customer experience around data quality and speed of access,” said Louise Billmeyer, Vice President and CIO of Principal Financial Group.[1] Implementing advanced analytics has improved the amount of accurate and detailed data the firms are able to acquire, but insurance CIOs know that it’s just the tip of the iceberg.

Our Forecast for Insurance Technology in 2019

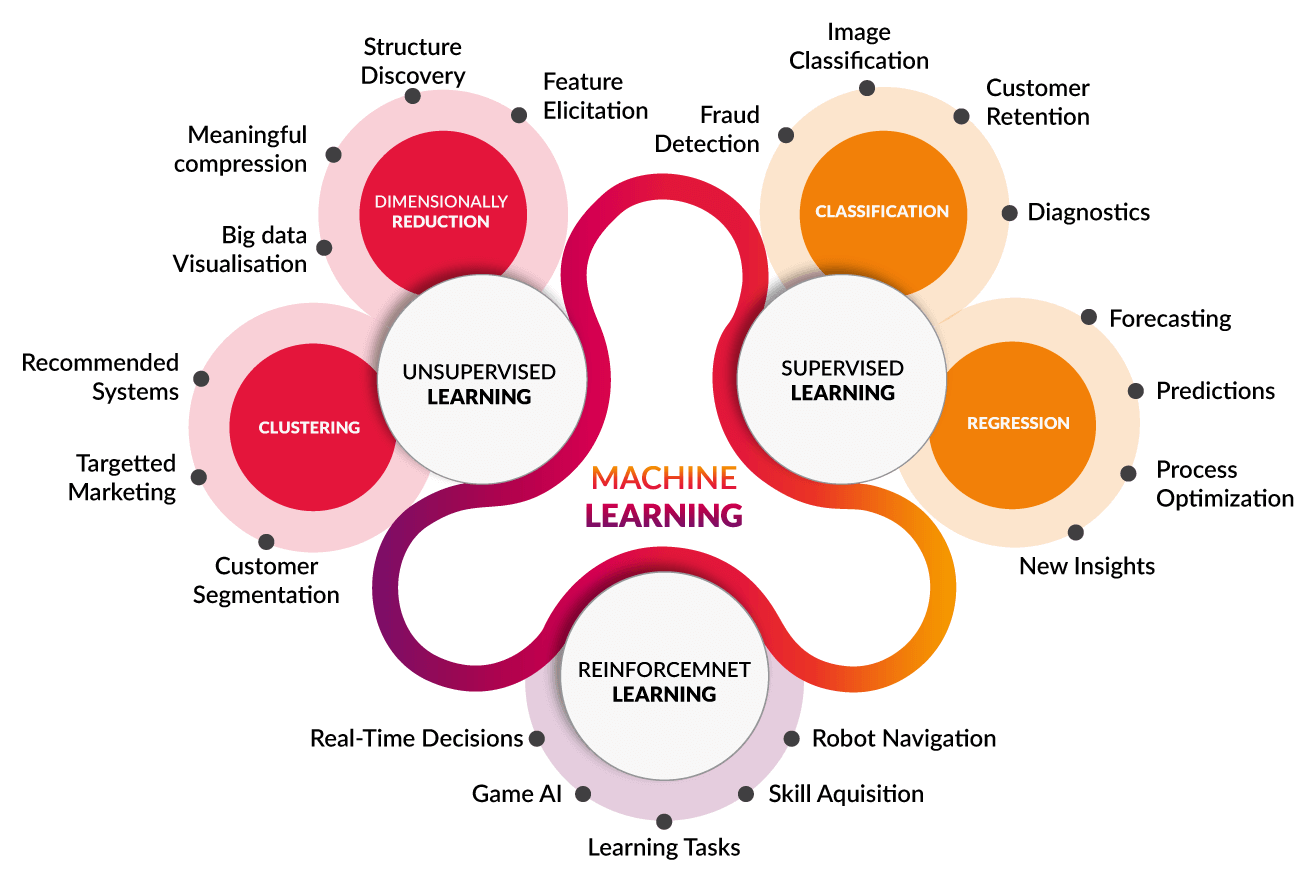

Machine Learning

When LOMA Resource asked CIOs what trends they were keeping an eye on, all four mentioned machine learning algorithms in the context of learning more about clients.[1] Machine learning, also referred to as deep learning, is exactly what it sounds like: computer systems that progressively learn and improve their performance on tasks using different forms of artificial intelligence. It uses technologies like data capture and natural language processing (NLP) to digest the data it retrieves and convert it into future predictions.

Leveraging machine learning allows insurance companies to segment customers in order to offer personalized products and solutions, improve risk management and reduce fraud by identifying more suspicious claims and exceptions in patterns. Since machine learning can deliver valuable client insights, insurers would benefit from implementing a solution that combines machine learning, data capture and NLP, such as our Medical Extraction product, which intelligently delivers critical applicant information to underwriters, saving hours of manual effort. With the ability for insurance companies to implement artificial intelligence, we’ll most likely be seeing more of them utilizing machine learning algorithms in 2019.

Continual Legacy System Updates

While many insurance companies have been updating their legacy systems for the last few years, some CIOs still believe the cost of uprooting their current system isn’t worth the benefits. However, James Nunn from Computer Business Review points out that holding on to old legacy systems, no matter how deeply rooted in the company’s infrastructure they are, will hurt the company in the long-run.

“IT and business leaders always think about sunken costs, and they don’t want to give up on them. But they have to think about sunken opportunity, and the high price their companies pay for missing out because of their antiquated infrastructure. In the fast-paced environment in which companies operate today, this legacy infrastructure from last century doesn’t allow them to move fast enough to seize an opportunity when they see it.”

Plus, the need to update a legacy system becomes more crucial each year that new industry-changing technologies begin to appear. The more advanced the technology, the less likely it will be able to easily integrate with an old system.

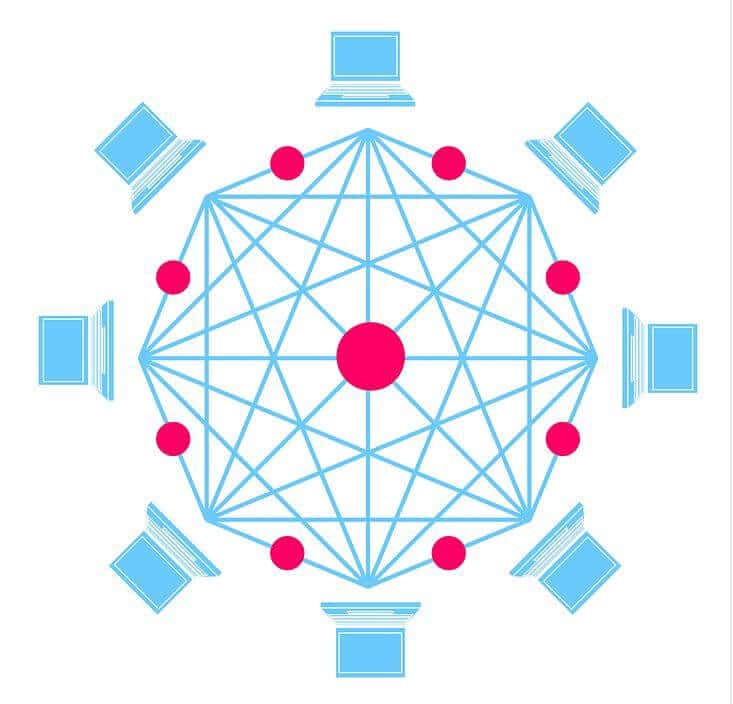

Blockchain

Blockchain technology will also become more prominent in 2019. In fact, the SAP Digital Transformation Study reported that CIOs in banking and insurance will more than double their investments in blockchain by 2019. Additionally, Forbes reported that Google search requests for “blockchain” have increased by 250% over the course of 2018. “I feel that as we look ahead the greatest potential impact will come from blockchain implementations. The potential to automate absolute trust transactions across the entire value chain of our business model is almost too much to think through,” Driscoll said, “The core concept of blockchain as a distributed ledger will have far reaching impacts cross all industries.”[1]

Implementing blockchain solves many problems the insurance industry faces such as having to ingest huge amounts of data, third party payments and fraud by increasing visibility in data and processes and verifying authentication. The most transformative benefit to blockchain is the elimination of third parties in customer transactions. Through personal digital devices used by the customer, insurers can easily and quickly view past claims and the directness increases trust between the client and the insurer. Billmeyer said, “By collaboratively leveraging blockchain technology to address business integration/sharing problems, the entire insurance industry stands to realize significant benefits. I’d compare its benefits to those delivered by the establishment of data standards.”[1]

RPA

Robotic Process Automation (RPA) is becoming exponentially popular due to the fact that it takes over monotonous human computer tasks so that employees can be shifted to higher revenue-generating tasks. RPA bots also greatly decrease processing time as well as errors often made by humans. Automation Anywhere has been fine-tuning their RPA solution for 14 years, so we’re seeing this type of automation being included in more technology companies’ product lineups. Now that it’s available across more industries, insurance companies are combining RPA with other technologies like artificial intelligence and data capture to take their automation to the next level.

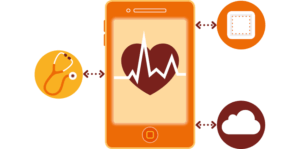

Digital Medicine

Digital medicine, more of a budding concept in the insurance sphere, is being implemented in hundreds of healthcare companies and  holds just as much promise for the insurance industry. Digital medicine is a concept that allows us to “digitize human beings using biosensors that track our complex physiologic systems.” According to Bain Insights, over 60% of insurance customers expressed interest in a digitization of healthcare services from their insurance providers. Not only is there a rising demand from clients, but the concept of digital medicine offers great potential for increasing efficiency in the insurance companies’ operations. “Digital medicine captures our attention with its potential to identify and address risks before they have negative impacts on our clients,” said Karl G. Gouverneur, Vice President of Digital Workplace and Corporate Solutions and Head of Digital Innovation at Northwestern Mutual.[1] Digital medicine holds the potential for insurers to personalize their plans according to an individual’s personal data generated from wearable sensors and trackers. It also has the long-term capacity to decrease rates overall in the way it encourages a shift from a “reactive care” model in insurance to a “preventative care” one.

holds just as much promise for the insurance industry. Digital medicine is a concept that allows us to “digitize human beings using biosensors that track our complex physiologic systems.” According to Bain Insights, over 60% of insurance customers expressed interest in a digitization of healthcare services from their insurance providers. Not only is there a rising demand from clients, but the concept of digital medicine offers great potential for increasing efficiency in the insurance companies’ operations. “Digital medicine captures our attention with its potential to identify and address risks before they have negative impacts on our clients,” said Karl G. Gouverneur, Vice President of Digital Workplace and Corporate Solutions and Head of Digital Innovation at Northwestern Mutual.[1] Digital medicine holds the potential for insurers to personalize their plans according to an individual’s personal data generated from wearable sensors and trackers. It also has the long-term capacity to decrease rates overall in the way it encourages a shift from a “reactive care” model in insurance to a “preventative care” one.

Looking ahead at 2019, it’s clear that the top initiative for insurance CIOs remains improving the customer’s experience. However, the technologies that will be used to reach those goals continue to advance. In our competitive financial landscape, technology is becoming a huge indicator of the future health of insurance companies.

What are your top technology initiatives for 2019?

Check out our resources below to explore some automation solutions that are possible for your business.

Watch our webinar series on IBM’s Digital Business Automation Platform

Download our Medical Extraction white paper

Additional References

1 Tammy McInturff Appel, “CIOs Discuss Strategy, Challenges and Industry Changes,” LOMA Resource. March 2018.

Layne Alfred

Marketing Associate