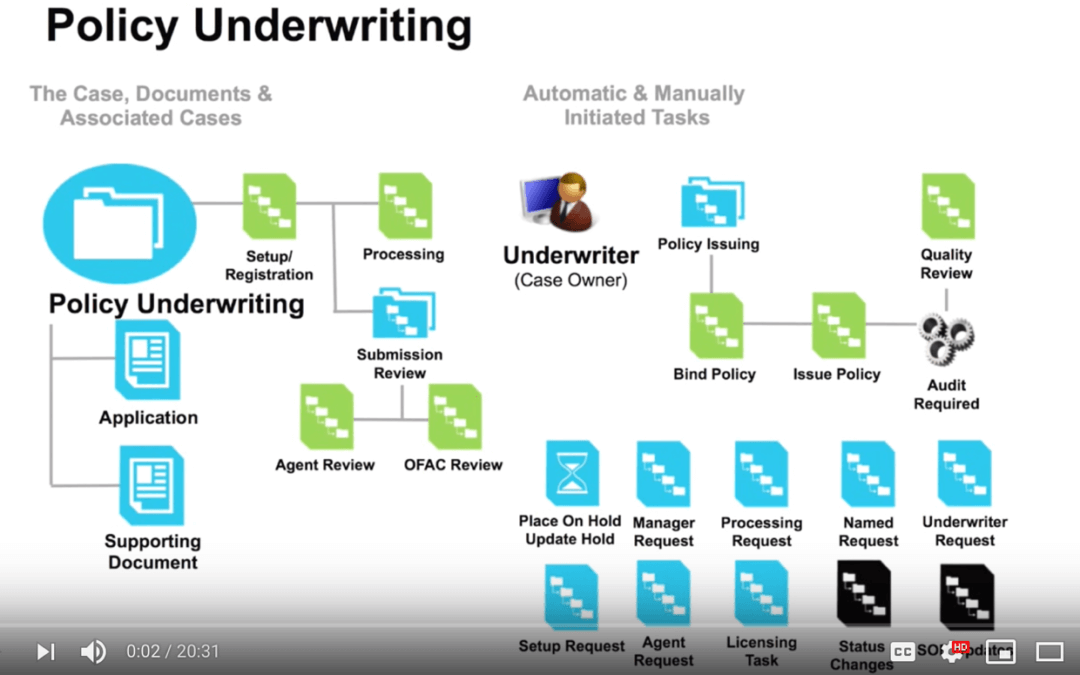

Pyramid eXpeditor for Policy Underwriting

This visionary solution helps insurance providers better process structured and unstructured content to decrease the time it takes to process a policy.

This visionary solution helps insurance providers better process structured and unstructured content to decrease the time it takes to process a policy.

Talk to any life insurance company and they will tell you that attending physician statements (APS) (also referred to as digital or electronic medical records) are the biggest delay in underwriting new applications. Ordering an APS is expensive ($50-$150 each), takes time to retrieve (10-30+ days) and is necessary for 20-30% of all life insurance applications (and if it is reinsurance, they require an APS for each application).

A 2014 Oxford University study concluded that jobs in the “service” and “sales and related” categories have high probability (greater than .7) of computerization (computerization is job automation by means of computer-controlled equipment). According to a McKinsey Global Institute report, the underwriting profession is vulnerable to having at least 35% of its tasks automated. Now, before you dust off your resume, let’s think about this a little further.

Pyramid Solutions is excited to attend and sponsor the Association of Home Office Underwriters (AHOU) 16th Annual Conference: Appetite for Disruption.

Recent advances in cognitive technology make life insurance underwriters more effective at assessing policy applications. This technology allows life carriers to extract key data from documents, process it into relevant information, and present it back to Underwriters – all within the context of their normal application review process. Anecdotal evidence indicates that this can increase the productivity of underwriters by 30% when assessing complicated applications.

“Stateside Insurance” is a fictional P&C insurance client. This is a story demonstrating how our life underwriting solution helps many similar insurers overcome common content and case management challenges.

Five myths about claims processing and the facts that debunk them.

Our client, an insurance firm, desired to optimized their investment in IBM ECM software and Guidewire. They had an ambitious goal in mind to leverage these technologies to become a completely paperless company.

The old saying two are more powerful than one definitely holds true for Guidewire products. When positioning Guidewire ClaimCenter against an environment that also has an enterprise content management (ECM) system or document management system, it’s obvious why the two together are more powerful and effective.

See how a nation-wide insurance provider overcame their inability to efficiently manage claims content by extending the functionality of Guidewire ClaimCenter.

Accelerating response to customers by streamlining underwriting and claims handling ECM processes.

The insurance landscape constantly changes due to increasing customer demands, commoditization, globalization and emerging technologies. Watch a 10-minute on-demand webcast to learn how your company can remain stable on shifting ground.