Blockchain technology promises to increase efficiency, security and accuracy within the extremely inefficient financial industry. On average, it takes a minimum of five different parties to execute a simple transaction. This makes processing times unreasonably long and expensive, not to mention it increases the likelihood of fraud and errors occurring since it has to pass through so many hands. With fintechs quickly gaining traction because of their blockchain adoption, traditional financial institutions are concerned about losing market share. As a huge disruptor to the financial industry, traditional banks will need to join the blockchain movement to keep up with emerging digital competitors. Below are 4 of the major ways banks today are using blockchain to streamline processes.

International Payments

Adam Ludwin, CEO and co-founder of Chain, believes one of the most important processes that blockchain will transform is international payments and trade. International wire payments are so complex right now that they can take several days and can also “eat up several points of the payment amount,” according to Ludwin.

Sam Mire at Disruptor Daily echoes this financial institution pain point with a few shocking statistics. Cross-border payments cost consumers $180 trillion a year– about $42 per transaction. On the other hand, blockchain charges less than 1% in fees and sends the actual payment within a few hours as opposed to up to 5 days.

“If we can put currency into a native digital format, instead of sending an electronic message, we can send the assets themselves electronically. The difference is what these cryptographic databases known as blockchains bring to the world,” continued Ludwin, “ If we can do that, if we can send the assets themselves as opposed to just sending messages, then I can pay a supplier in Vietnam as fast as I can send an email to Vietnam.”

Not only can blockchain accelerate and reduce costs of international payments, but financial experts also expect to see an increase in accuracy and transparency in cross-border trade and payments. Any time there are as many parties involved as there can be with international payments, things can slip through the crack and mistakes or “miscommunications” can occur. Blockchain takes out the middleman (or ‘men’ in this case), reducing errors and saving the time it would take to correct those errors.

In addition, there is a lot of uncertainty that comes with cross-border payments. Senders and receivers alike want to be able to track their payments and make sure the process is happening the way it should be– but right now, they can’t. Blockchain technology, with its public and open nature, gives end-to-end transparency to all parties involved. This way, if something is incorrect, it’s much easier to resolve, mostly because the parties involved will know about the issue, but also because they’ll know about the issue almost immediately.

Settlement Processes

In a way, blockchain eliminates the need to “settle” payments at all since it enables close to real-time transactions. Since it’s a distributed, public ledger of transactions, there’s no need to coordinate payments on complicated systems like SWIFT that banks around the world use today to send payment orders, according to CB Insights. Just like with international payments, domestic payments take days before being cleared and settled, but with blockchain, transactions are settled immediately and publicly.

Additionally, CB Insights estimates that “blockchain innovation could cut at least $20B worth of costs from the financial sector by providing better infrastructure for clearance and settlements.” Think about how you could use that money to actually improve your business rather than just maintaining it!

Loan Syndication

The distributed nature of the blockchain makes loan syndication more transparent to all parties involved, but most importantly, it makes loans much more secure and accurate. For example, if one of the party’s server crashes, all the information is still available and easy to retrieve since it is distributed.

This combined with digital signatures and time stamps makes it impossible to tamper with forms and contracts once they’ve been added to the ledger. This is because the authentication of the document happens at the transaction level– every party involved in the transaction are witnesses to any changes that might happen on the public ledger. For example, BBVA, one of the first banks to issue syndicated loans with blockchain, has demonstrated that immutability of the information is guaranteed with their use of “unique document identifiers” and electronic signatures. Any change made to a document after the fact voids the integrity of the document altogether.

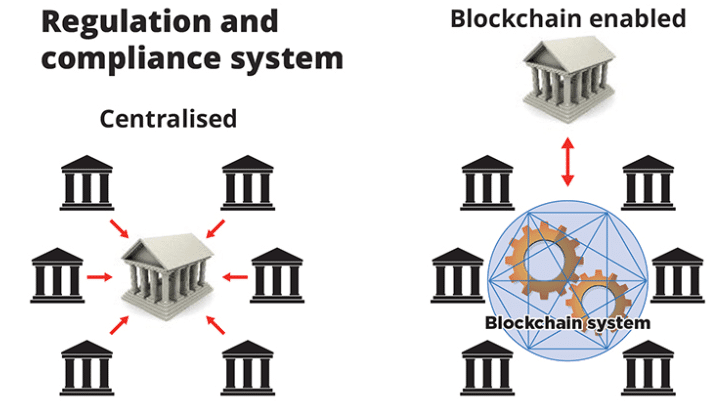

Regulatory Reporting

The financial industry is one of the most regulated, so being able to automate regulation updates to stay compliant with blockchain will be a huge time and money saver. Since a lot of traditional banks use their own ledgers, there is a lot of ‘reinventing the wheel’ so to speak as far as regulation updates, and often times, there are many inconsistencies.

But with blockchain, the process of regulatory reporting can be completely automated. Professor Tomaso Aste from the UCLA Centre for Blockchain Technologies says, “Blockchain technologies can reverse the way regulation and compliance are presently performed, creating an environment where both market players and regulators have access to trusted auditable data relieving firms from compliance duties and compliance risks.” Because the distributed ledgers are tamper-proof (as we mentioned about above), public and verified, regulators and government entities can easily share compliance files right on the blockchain for every bank to be able to quickly access.

But with blockchain, the process of regulatory reporting can be completely automated. Professor Tomaso Aste from the UCLA Centre for Blockchain Technologies says, “Blockchain technologies can reverse the way regulation and compliance are presently performed, creating an environment where both market players and regulators have access to trusted auditable data relieving firms from compliance duties and compliance risks.” Because the distributed ledgers are tamper-proof (as we mentioned about above), public and verified, regulators and government entities can easily share compliance files right on the blockchain for every bank to be able to quickly access.

To stay relevant and be able to compete in today’s market place, traditional banks can no longer wait to update their systems and technologies. They need to act fast, and luckily, there are several ways traditional banks can use blockchain to ensure competitive advantages by combining it with existing brand presence and market share. Once traditional banks adopt blockchain, it will be interesting to see how fintechs and digital banks plan to increase their market share to continue to compete.

Blockchain can seem a bit overwhelming (and even scary) with how new it is and the various claims that the ‘possibilities are endless.’ I get it. If you are not quite ready to jump into blockchain there are a number of other ways you can automate operations to increase overall efficiency. My team has written a few good posts on them. Check them out here:

Electronic Signatures Narrowing Gap in Closing Table Process

3 Keys to Deliver Exceptional Trust and Wealth Mgmt. Customer Experiences

4 Levels of Visibility to Improve Client Onboarding