For an industry typically associated with being stale and stagnant, the latest insurance software products are definitely not those things. Every day visionary tech and software companies release new products that improve the back-end experience for users of insurance software and the front-end experience for insurance consumers.

Here are a few different insurance software products and technologies that are moving the industry from stale and stagnant to innovative and influential.

Pulse – A Dynamic Risk Stratification App

I don’t usually get super geeked by this kind of stuff, but this is actually a pretty cool insurance software product. Check out this excerpt from a recent Forbes article regarding big data and analytics.

“We are getting to the point now where companies have so much data that we can start to model the risk factors associated with a given patient or procedure. For example, we can assume how likely someone is to be readmitted back to a hospital, or what their anticipated recovery time will be…That’s why I [Nitin Goyal, MD, Orthopedic Surgeon] chose to develop my own healthcare platform, called Pulse. It is a cloud-based mobile and web platform, and what Pulse does is it follows up with patients after a surgical procedure to ensure that they are recovering in the best way possible.

“The primary difference between big data collection and what we’re doing with the Pulse platform, however, is that big data is reflective – it can really only evaluate a static data set. I like to call what we’re doing with Pulse ‘Dynamic Risk Stratification.’

“What this means is that most people stratify risk prior to an intervention, looking at previous data sets to anticipate the future. For example, a patient might be identified as being high risk for a certain procedure based on a history of heart disease, and we can reach that conclusion by looking at thousands and thousands of cases of similar patients. And while that data is absolutely important, it’s really only part of the puzzle.

“Taking it a step further, and what we’ve implemented into the Pulse platform, is a constant and dynamic stratification of a patient’s risk level.”

I’ll use myself as an example to explain this. Let’s say I get knee surgery and prior to the procedure, I’m considered low risk. On day three after the surgery, the Pulse app asks me “Is your wound dry?” If I answer “No,” then I am automatically re-stratified to a high-risk patient because at that point, following knee surgery, I’m at high risk for infection.

“The opportunity in this space isn’t just to gather large sets of data and draw sweeping conclusions. It’s to be constantly re-stratifying risk levels, especially in scenarios of interventions or high-risk procedures.”

Life insurers are in such a unique position because they collect an immense amount of data on their clients. To not leverage that data is to sacrifice a competitive advantage. By using an insurance software product app like Pulse, insurers can constantly re-stratify risk levels and keep their risk at bay.

Cognitive Medical Extraction

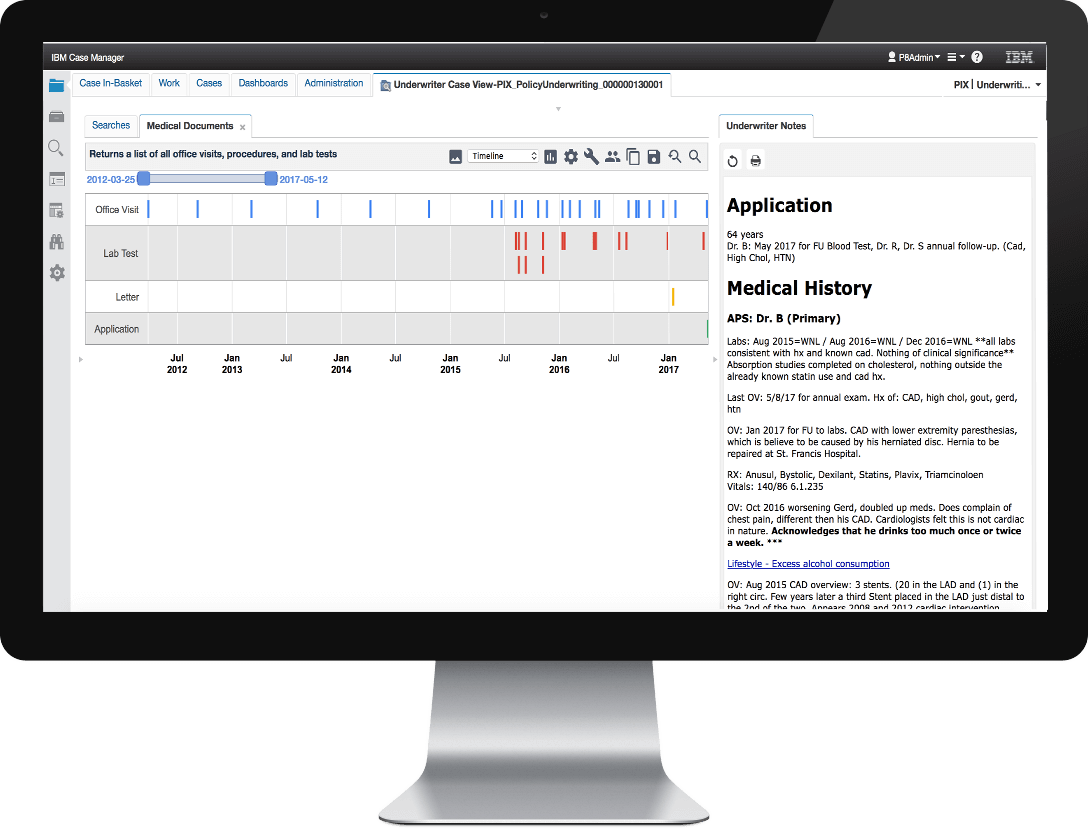

This is an aspect of one of our own offerings: Pyramid Solutions’ Life Underwriting Solution.

Via cognitive capture, the solution captures specific medical data from patient documents such as APSs, doctor’s notes, prescriptions, etc. and assimilates it in a way that the underwriter only has to review the information that aids in making a decision. It eliminates countless hours of searching through documents and reviewing data that’s unimportant.

It does this for structured (template-based) and unstructured (free-form text, hand-written notes) documents. The coolest part is how it assimilates the data: in easy-to-read timelines that tell a story to the underwriter about the applicant’s risk. These timelines show overlapping diagnoses, medications, etc. so an underwriter can quickly see areas of concern or potential risk.

From there, the underwriter can further drill down into information, take notes, set a task for his manager to review, or request the agent for additional information.

Having this kind of power and insight at the front of an underwriting process enables insurers to easily fast-track applicants with low risk.

Blockchain

We often hear of blockchain technology in reference to the banking industry, but it also has potential applications as an insurance software product. A recent report published by McKinsey & Company talks about three ways blockchain could facilitate growth for insurers.

One of these is improving customer engagement. With recent hacks to organizations like Uber and Equifax, many consumers worry about the safety of their personal information. This is where blockchain steps in. Instead of verifying an applicant’s personal data or personal medical information with a doctor or related transactions, the verification is registered in the blockchain.

Once the blockchain verifies the customer data, the customer can forward the verified information to other providers, avoiding the need to repeat the full identification and verification process. This would greatly increase the speed and efficiency of new client onboarding or policy underwriting.

IBM Watson

Triage an Influx of Claims After a Natural Disaster

IBM Watson™ is another cool source of innovation for insurance software products. One use for Watson Explorer is to gauge customer sentiment. How it works is “IBM Watson Tone Analyzer uses linguistic analysis to detect emotional and language tones in written text.”

A great example of a use-case for this insurance software product is with P&C insurance providers. In a recent webinar we hosted with IBM, one insurer shared how on average it processes 700 claims per month, but after a natural disaster like a hurricane, that number spikes to 40,000 per month!

To triage the influx of claims, the insurer uses Tone Analyzer on incoming claims, emails, etc. to interpret the seriousness and determine which claimants are hurt worse, who needs immediate attention, etc. (Move to the 19-minute mark in this webinar to hear this example in more detail.)

Perform Medical Claims Assessments

Another use-case for Watson is for performing medical claims assessments. AIA, one of Australia’s largest life insurers, put Watson to the test for two weeks. In that short time, Watson “learned to ingest policies and make accurate decisions with a degree of efficiency it typically takes a human assessor up to five years to achieve.” AIA reported that Watson achieved 99% accuracy. Watson’s ability to create smart rulesets and learn as it goes makes it a substantial productivity tool.

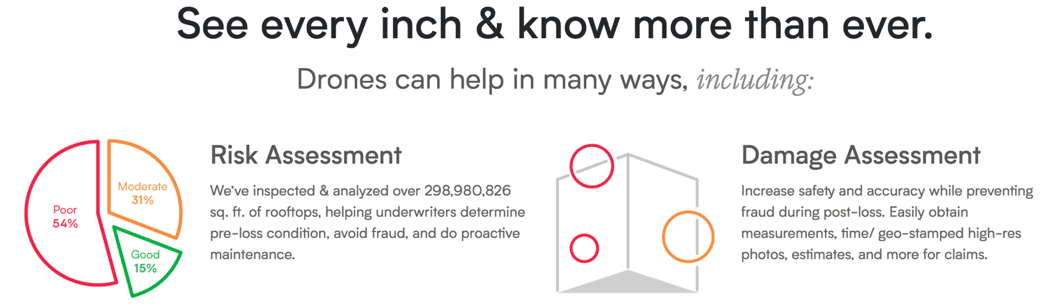

BetterView – An App for Drone-Based Property Inspections

This app uses drones as a safe and cost-effective way for insurers to capture aerial building imagery and data. The screenshot snippet of their website below speaks for itself.

These are just a few examples of innovative insurance software products and technologies. For an industry that’s commonly known as being stagnant and stale, it’s hard to continue to think that after learning about all of these technologies. Be on the lookout for how these technologies, and trends like cloud, SaaS platforms, and automation, develop.

If you want to stay up to date on the latest insurance trends and technologies, subscribe here for sporadic updates and insider information.

Taylor Trapani

Marketing Associate